Why Waya Recognizes Bitcoin as a Distinct Asset Class

Posted On : Fri Dec 12 2025

Figure: Institutional Adoption of Bitcoin Is Growing

Bitcoin’s Scarcity & Decentralization Set It Apart

Bitcoin stands apart from traditional assets due to its unique combination of digital scarcity, decentralization, and immutability. These characteristics give it a foundational profile that does not resemble equities, bonds, currencies, or commodities.

1. Fixed Supply (Digital Scarcity)

Only 21 million Bitcoin will ever exist. This fixed supply creates a predictable and transparent scarcity model that supports long-term value preservation and resists monetary dilution.

2. Decentralization

Bitcoin operates without central authority. It is maintained by a global network of participants, making it politically neutral, censorship-resistant, and structurally different from sovereign currencies or corporate financial systems.

3. Immutability

Once recorded on the blockchain, Bitcoin transactions cannot be altered. This ensures secure and permanent ownership records, establishing a high degree of trust and reliability in the system.

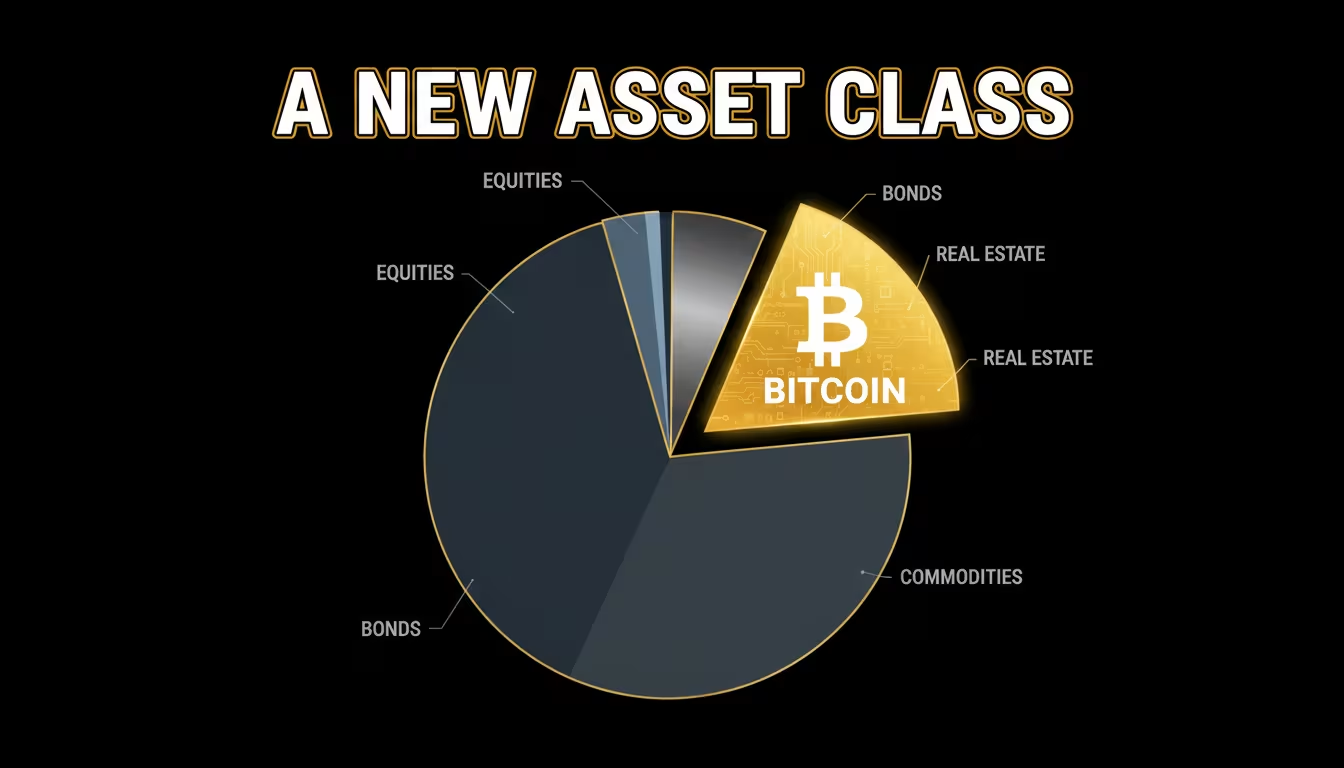

Figure: Bitcoin emerging as a new global asset class

Low Correlation with Traditional Assets

Another reason Bitcoin is treated as a separate asset class is its historically low correlation with traditional markets such as equities and fixed income. This makes Bitcoin a powerful component for enhancing diversification.

- Diversification potential: Bitcoin behaves differently from stocks and bonds.

- Portfolio benefit: Its price movements can offset stress in traditional markets.

Store of Value

Although Bitcoin began as an electronic peer-to-peer payment system, it has increasingly been adopted as a store of value. Its finite supply and independence from monetary policy make it attractive as a hedge against inflation and currency dilution.

- Hedge Against Inflation: Fixed supply protects against currency debasement.

- Investability: Bitcoin trades globally 24/7, and regulated ETF products have increased accessibility.

Institutional Adoption and Market Size

Institutional participation has significantly accelerated Bitcoin's recognition as an asset class. The increasing market size, regulatory clarity, and participation by major financial institutions have helped move Bitcoin from a niche technology into mainstream investment frameworks.

- Market Capitalization: Bitcoin’s valuation now rivals major global assets.

- Financial Integration: Asset managers, hedge funds, and family offices are allocating meaningfully.

Conclusion

In short, Bitcoin is increasingly recognized as a separate asset class because it functions as an investable store of value with a unique risk–reward profile. Its scarcity, decentralization, and low correlation to traditional markets make it unlike any existing financial instrument. As institutional participation grows, Bitcoin’s role in global portfolios continues to expand.

Regards

Amit Vora, CEO