Dollar Strength, Capital Flows & Emerging Market Volatility

Posted On : Wed Dec 24 2025

Introduction: The Market Force Investors Don’t See—but Always Feel

When markets turn volatile, investors often look for answers in earnings, budgets, or elections. Yet, time and again, the real trigger lies elsewhere—the strength of the US dollar and the direction of global capital flows.

Dollar strength is not just a currency story. It is a global liquidity signal—one that quietly decides whether money flows into or out of emerging markets like India.

Understanding this relationship is no longer optional. It is essential for equity investors, FnO traders, commodity participants, and PMS portfolios alike.

What Does “Dollar Strength” Actually Mean?

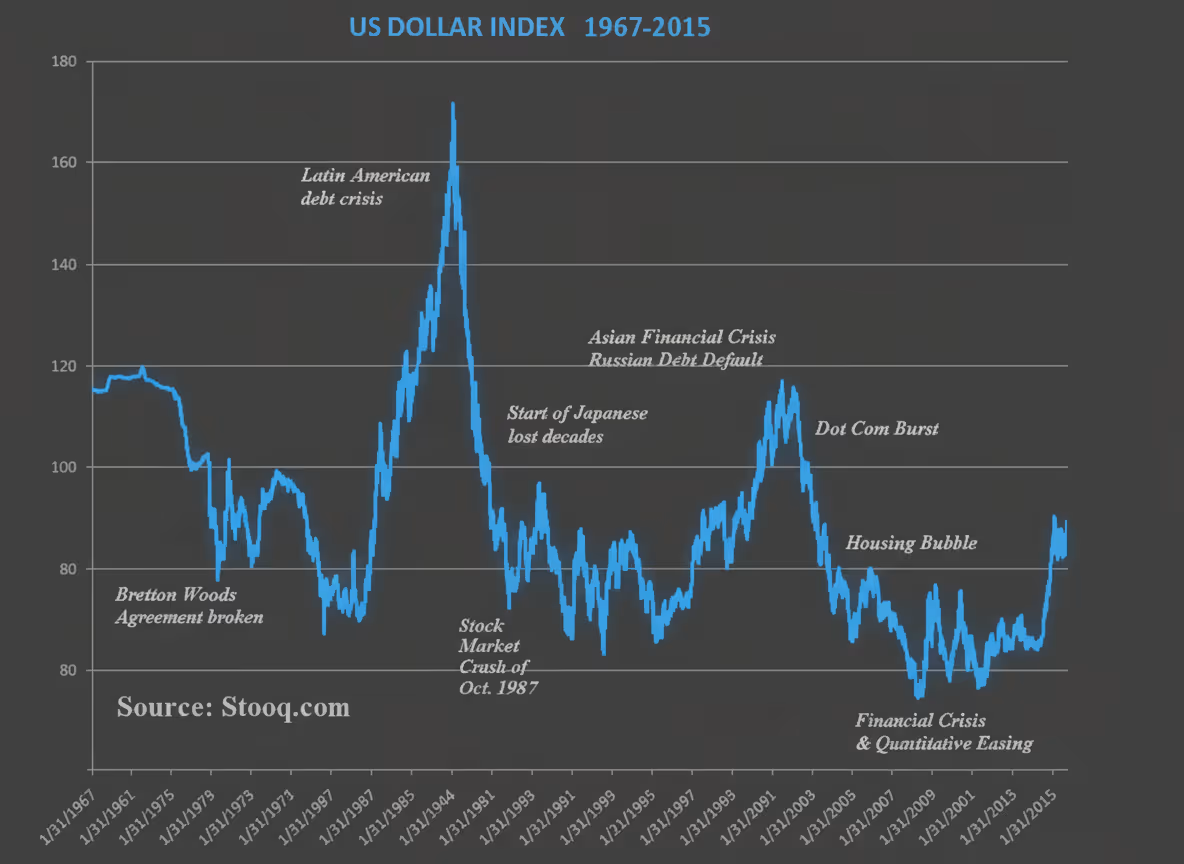

A strong dollar usually refers to the appreciation of the US dollar against a basket of global currencies, often tracked using the US Dollar Index (DXY).

But here’s the nuance most discussions miss:

The dollar strengthens not because the US is booming—but because global liquidity is tightening.

Dollar strength typically coincides with:

- Rising global interest rates

- Reduced availability of cheap capital

- Higher risk aversion among global investors

In short, it signals capital becoming scarce.

Capital Flows: The Real Transmission Mechanism

Capital doesn’t move randomly. It moves toward:

- Higher real yields

- Lower risk

- Better liquidity

When the dollar strengthens:

- US assets become more attractive

- Global investors repatriate capital

- Emerging markets face outflows

This is why capital flows, not fundamentals, often dominate short- to medium-term market moves.

Markets don’t fall because companies are bad. They fall because the capital chooses safety.

Why Emerging Markets Are More Vulnerable

- External funding

- Dollar-denominated trade and debt

- Foreign portfolio flows

When the dollar rises, emerging markets experience currency depreciation, imported inflation, higher borrowing costs, and equity market volatility.

This is not a failure of growth—it’s a liquidity constraint.

India: Strong Economy, Still Not Immune

- FII outflows from Indian equities

- Pressure on INR

- Sectoral rotation (exporters vs importers)

- Higher volatility in index and FnO markets

Even the best domestic stories temporarily pause when global liquidity tightens.

Markets Don’t Reward Optimism—They Reward Preparation

Dollar strength, capital flows, and emerging market volatility are not isolated events. They are part of a global liquidity framework.

Investors who understand this framework react less—and position better.

Because in markets, capital moves first. Narratives follow later.

The Waya Perspective: Macro Awareness Is Risk Management

Understanding liquidity cycles enables better positioning across Equity, FnO, Commodities, and PMS portfolios.

Want deeper insights on macro cycles and portfolio positioning? Explore Waya’s research-driven approach to navigating global market regimes.

Regards

Amit Vora, CEO